The price of Viagra per pill varies significantly, ranging from $20 to $70 depending on factors like dosage, pharmacy, and whether you use insurance or a discount program. Generic sildenafil, the active ingredient in Viagra, is considerably cheaper, often costing between $10 and $30 per pill.

Your best strategy involves comparing prices across multiple pharmacies, both online and brick-and-mortar. Online pharmacies may offer competitive prices, but always verify their legitimacy to avoid counterfeit medications. Many pharmacies offer discount programs or coupons which can reduce the overall cost substantially. Consider utilizing these to lower expenses.

Insurance coverage plays a crucial role. Some insurance plans cover Viagra or sildenafil, but coverage depends on your specific plan and doctor’s recommendations. Check your policy details or contact your insurance provider directly for clarification on prescription drug coverage. Exploring these different avenues will help you find the most cost-effective option for your needs.

Remember: Never purchase medications from unverified sources. Counterfeit drugs can be dangerous and ineffective. Prioritize your health and safety by using reputable pharmacies and consulting with a healthcare professional before beginning any new medication.

How Much Does Viagra Cost Without Insurance?

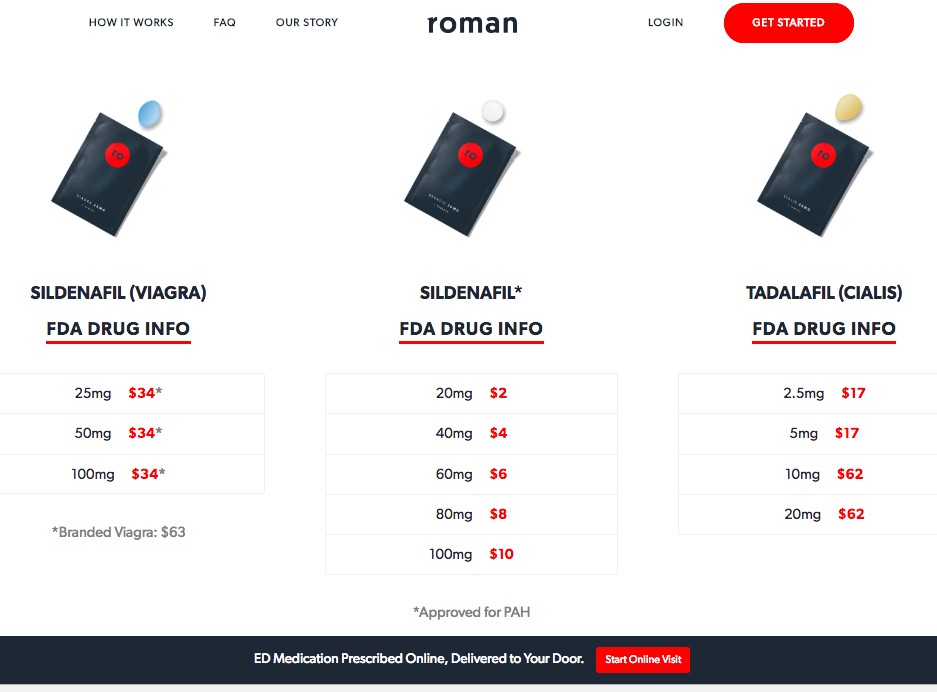

Expect to pay between $30 and $70 per pill for Viagra without insurance coverage. This price varies significantly depending on the pharmacy and dosage (25mg, 50mg, 100mg). Larger pharmacies often offer slightly lower prices than smaller, independent ones.

Factors Affecting Price

Pharmacy: Big chain pharmacies may have bulk discounts leading to lower prices. Dosage: Higher dosages generally cost more. Generic Sildenafil: Consider generic Sildenafil, the active ingredient in Viagra. It’s significantly cheaper, usually costing between $10 and $30 per pill. Manufacturer: While Pfizer manufactures Viagra, other pharmaceutical companies produce generic versions.

Finding Affordable Options

Compare Prices: Use online pharmacy comparison tools to find the lowest prices in your area. Consider Generic Sildenafil: This is a cost-effective alternative that provides the same active ingredient. Negotiate: Discuss pricing options with your local pharmacy; some may offer discounts. Prescription Savings Programs: Explore programs such as GoodRx that provide discounts on medications. Always consult your doctor before switching medications or using discount programs.

Important Note

Price fluctuations are common. Always verify the current price with your chosen pharmacy before purchasing. This information is for guidance only and shouldn’t replace professional medical advice.

How Much Does Viagra Cost With Insurance?

Your out-of-pocket Viagra cost depends heavily on your specific insurance plan. Some plans cover it completely, while others may require significant co-pays or may not cover it at all. Factors like your deductible, co-insurance, and formulary status all influence the final price.

Checking Your Coverage

The best way to determine your cost is to contact your insurance provider directly. Ask about your plan’s coverage for sildenafil (the generic name for Viagra) and any associated co-pays or deductibles. You should also inquire about prior authorization requirements; some plans necessitate pre-approval before covering Viagra. Your pharmacist can also provide cost estimates once you have your prescription.

Generic Options

Consider using sildenafil, the generic version of Viagra. Generic medications are typically far less expensive. Check if your insurance plan prefers generic drugs; this can significantly reduce your cost. Discuss this option with your doctor; they can prescribe the generic alternative if appropriate for your health needs. This is frequently a much more affordable route.

Exploring Cost-Saving Programs

Pharmaceutical companies often offer patient assistance programs to help reduce medication costs. Check the manufacturer’s website (Pfizer for Viagra, or the generic manufacturer) for details on potential savings programs. These programs can provide significant discounts or even free medication in specific circumstances.